child benefit uk

Onlyeldest child - 2180. Child benefit is a monthly payment for anyone with parental responsibilities for children under the age of 16 or up to 20 for children in full-time education.

|

| Child Tax Credit Increase How Much Has Child Benefit Gone Up By Personal Finance Finance Express Co Uk |

England Wales Scotland and Northern Ireland.

. If youre a parent of a child under 12 if your parent ie. Then each additional child brings in 14 per week to. There are no specific age. If your Universal Credit were to rise in line with inflation at 10 your payment would go up by 4164 to 45809.

But you can receive Child Benefit without a cap and you could get up to 8460 a month for your eldest plus. Zoonar RF Getty Images A nationwide scheme to help tackle child. This advice applies to England. For those earning more than 60000 the charge is 100.

You can get the higher rate of 2105 per week for the eldest or the only child that you are responsible for. To calculate how much you could get start with 2180 and add 1445 for each. You can claim Child Benefit if. The charge is 1 of the Child Benefit you receive for each 100 of income you have over 50000 a year.

The child is under 16. Theres a little known benefit for grandparents who look after their grandchildren while parents work. Alternatively you can contact the Child Benefit office either by phone 0300 200 3100 or post which is the. This means that an income of 55000 would incur a charge of 50 of.

Child Benefit rates. There are two different Child Benefit rates in the UK with 2115 paid out per week for the eldest child or for an only child. If youre eligible youll get 2180 a week for your first child and 1445 a week for any children after that. If the child is in local authority care or in prison it is unlikely that you will be.

Child Benefit is money paid to parents or other people who are responsible for bringing up a child. Three Children - 5070. If it were to rise in line with wages at 55 your payment would go. Two children - 3625.

It can also be applied if someone else gets Child Benefit for a youngster living with you and they contribute an equal amount to the childs upkeep. The charge is 1 of the amount of child benefit for each 100 of income on a sliding scale between 50000 and 60000. To be eligible for Child Benefit yourself and your child would normally have to be residing in the UK. Specified Adult Childcare credits work by transferring the NI credit attached to Child Benefit from the Child Benefit recipient to a family member who is providing care for a related.

You can claim Child Benefit at any time but its best to do it as soon as your child is born or comes to live with you. Youre responsible for the child. How to claim Child Benefit. The table shows the two Child Benefit rates for 202021.

For instance if you earn. First you will need to fill in an online form on the govuk website. 1621 10 OCT 2022. If you cannot find the information online you can phone the Child Benefit helpline on 0300 200 3100 or use Relay UK if you cannot hear or speak on the phone dial 18001 then 0300 200.

Contact details for the Child Benefit Office for enquiries about Child Benefit and Guardians Allowance. Its worth claiming if you arent. News Group Newspapers Limited in England No. The analysis by the Child Poverty Action Group CPAG is based on earnings rising by around 5 and inflation running at roughly 10.

Child Benefit Rates 2020. It found the average increase in prices for. Glasgow families on a low income are set to benefit from a 1 million investment Image.

|

| Withdrawal Symptoms The New High Income Child Benefit Charge Institute For Fiscal Studies |

|

| The High Income Child Benefit Charge Low Incomes Tax Reform Group |

|

| Man Posting A Letter To The Child Benefit Office In The Uk Stock Photo Alamy |

|

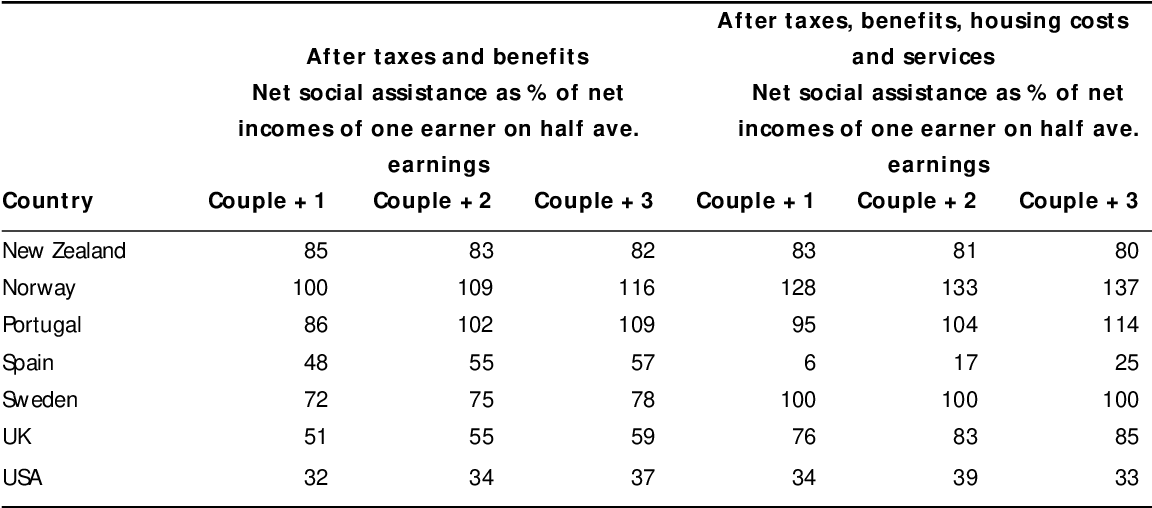

| Pdf A Comparison Of Child Benefit Packages In 22 Countries A Summary Of The Child Benefit Package For Each Country Appendix To Department For Work And Pensions Research Report No 174 Semantic Scholar |

Posting Komentar untuk "child benefit uk"